Salmon Evolution planning 31,500-tonne US facility

Salmon Evolution, which is building on-land salmon farms on Indre Harøy in Norway and in Korea, today announced plans to expand to the United States. It has also increased its long-term production target to 100,000 tonnes of head on gutted (HOG) salmon.

In a stock exchange announcement, the company said it is currently evaluating identified potential sites in North America and expects to use the remainder of 2022 for such site selection and initial site verifications.

“It is expected that the pre-construction phase including regulatory approval processes will take 2-3 years, allowing for construction start during 2025, upon which the plan is to build a full scale 31,500 tonnes HOG ‘Indre Harøy’ facility, drawing on the experiences learned in both Norway and Korea,” sated Salmon Evolution.

“To facilitate this expansion, the Company has established a dedicated team of both in-house and external resources. Additionally, the Company will establish a US corporate structure under its full ownership.”

Project pipeline

Chief executive Håkon André Berg said the company had always had global ambitions.

“With the addition of North America into our portfolio, we will have an operating platform on all the three major salmon consuming continents,” said Berg.

“Over the coming 12 months we expect to demonstrate the operational viability of our concept, solidifying Salmon Evolution’s global leadership position within the land-based salmon farming industry. Given the long lead times for this industry, we see it as critical for our long-term value creation to build and develop a tangible pipeline of high-quality projects.”

Partnerships

Salmon Evolution has partnered with Asia seafood giant Dongwon Industries to develop the salmon farm in Korea and indicated that it will also look for a partner in the US.

“The Company's strategy of strategy of pursuing accretive partnerships in overseas markets remains unchanged,” the company said. “As the project develops, Salmon Evolution aims to engage in partnership structures leveraging the Company’s human capital and maximising shareholder value.”

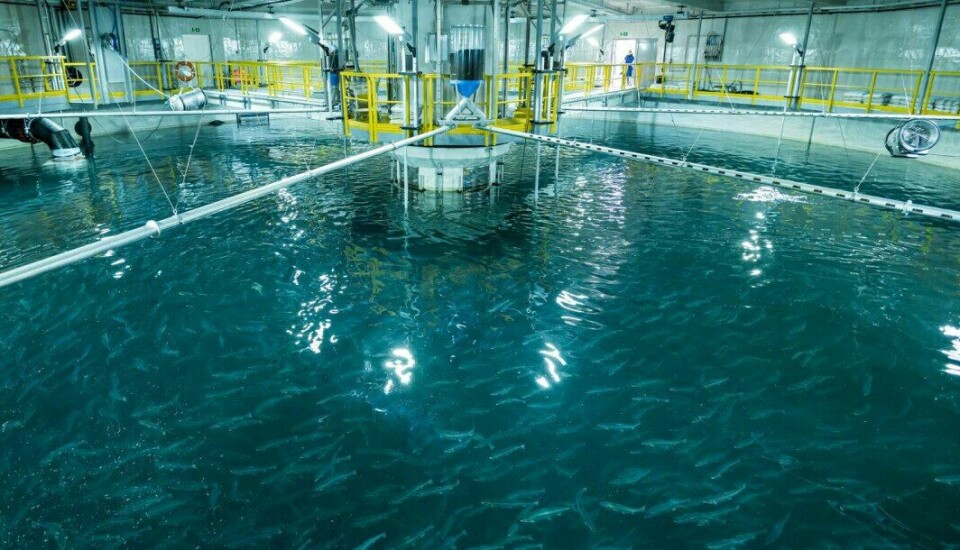

Salmon Evolution is using a hybrid flow-through system (HFS) with about water 65% reuse and 35% new supply in the form of filtered fresh seawater, which means its facilities must be sited on the coast.

Delays and setbacks

The company joins a growing list of US on-land salmon farming projects, some of which have been delayed or encountered setbacks.

These include Nordic Aquafarms, which plans 33,000-tonne recirculating aquaculture system (RAS) salmon farms at Belfast in Maine and at Humboldt in northern California. Nordic first announced plans to build a salmon facility in Belfast in January 2018 but has faced stiff opposition from some residents and has had to go to court to prove its right to lay inlet and outlet pipes into the local bay. Things have gone more smoothly in California, but the company faces a multi-million-dollar bill to clean up the brownfield site there.

Whole Oceans is another company planning a RAS salmon farm in Maine, on the site of a disused paper mill in the town of Bucksport. Development of the 20,000-tonne fish farm has been delayed because of a legal dispute involving Whole Oceans’ parent company, Emergent Holdings, and Nicholas and Gabriel Pranger, who previously sold their aquaculture engineering firm PR Aqua to Emergent Holdings. That dispute is now reported to have been settled, allowing Whole Oceans to progress in Maine.

Maryland, Virginia and Ohio

AquaCon, which like Nordic is Norwegian-owned, plans a 15,000-tonne salmon RAS on Eastern Shore, Maryland, and Pure Salmon, owned by Singapore-based 8F Asset Management, is in the early stages of construction of a 10,000-tonne RAS facility in Virginia.

Transgenic-salmon farmer AquaBounty already produces fish in a RAS in Indiana and has begun work on a 10,000-tonne RAS in Pioneer, Ohio.

In Florida, Atlantic Sapphire has ancountered a number of problems including die-offs, cleaning staff being overcome by fumes, and an oxygen shortage due to the demand caused by Covid. But the Norwegian-owned company, which harvested its first fish in 2020, has reported improved growth and is working towards steady state production of 10,000 tonnes per year in the first phase of its Bluehouse RAS, where it plans to eventually produce 200,000 tonnes of salmon annually.