Norwegian salmon export value up 7% in 2019

Norway exported 1.1 million tonnes of farmed salmon worth NOK 72.5 billion (£6.26bn) in 2019, according to figures from the Norwegian Seafood Council.

Volume increased by 6% and value increased by NOK 4.8bn (7%) compared to 2018.

“The weakening of the Norwegian krone and increased demand for Norwegian salmon are the two main reasons for the value increase in 2019,” said Paul T Aandahl, seafood analyst at the Norwegian Seafood Council.

More to China

The Council said a doubling in the amount of fresh salmon going to China led a NOK 1.5bn increase in the value of seafood exported to the country.

The volume of trout exported by Norway increased by 29% to 59,600 tonnes. The export value of trout was NOK 3.7bn, an increase of NOK 707m (24%) compared to 2018.

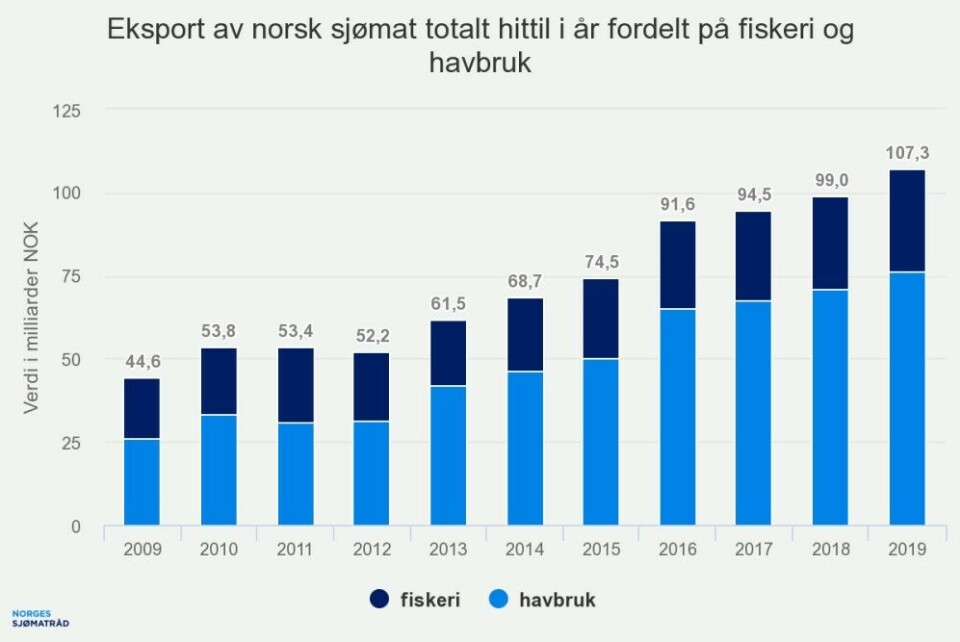

The total amount of wild-caught and farmed seafood exported from Norway in 2019 was 2.7m tonnes worth NOK 107bn.

Of this, 1.2m tonnes with a value of NOK 76.5bn came from aquaculture, meaning that aquaculture accounted for 44.6% of seafood export volume and 71% of the value.

Fishing accounted for 55.4% of seafood export volume and 29% of the value.

Meeting society’s trends

“The Norwegian seafood industry delivers good products that meet the trends in society,” said Renate Larsen, chief executive of the Norwegian Seafood Council.

“Consumers all over the world want healthy, sustainable food with good taste, and Norwegian seafood provides it in a very good way. Both the aquaculture and fisheries sectors have contributed to a record high export value for 2019.”

Tom-Jørgen Gangsø, the Council’s director of market insight and market access, said: “We have seen an increase in prices for several of our most important commercial species, in addition to the weak Norwegian krone and market access being relatively good. In sum, this has led to strong demand and higher prices for Norwegian seafood.”

Exports up to Asia

Norwegian seafood producers exported 1.6m tonnes of seafood to the EU for NOK 68bn last year. This is down 7%in volume, while the value increased by NOK 2.4bn (4%), from 2018.

In 2019, 506,000 tonnes of seafood worth NOK 21.4bn were exported to Asia. There is a 6% growth in volume, while the value increased by NOK 3.7bn, or 21%, from 2018.

The export volume to Eastern Europe decreased by 2% to 168,000 tonnes, while the value ended at NOK 4.3 billion, a 19% increase compared to 2018.

Poland, where much secondary processing is carried out, is Norway’s largest market in terms of export value, with 230,000 tonnes of seafood worth NOK 10.6bn exported in 2019. This is an increase of 1%in volume and NOK 407m (4%) in value.

Denmark second most valuable market

Denmark is now the second largest market for Norwegian seafood in terms of export value. Norway exported seafood for NOK 9.2bn to Denmark in 2019. This is an increase of NOK 660m, or 8%, from 2018. Apart from Poland, China was the largest growth market in 2019 - with growth in all NOK 1.5bn, or 40%, to a total export value of NOK 5.2bn. This made China Norway’s seventh most important market in 2019.

“Our surveys and seafood studies show that consumers around the world already largely perceive seafood from Norway as safe, sustainable and high quality,” said Larsen.

“If we are even more able to position Norwegian seafood as the most sustainable choice, our calculations show that the export value can also be doubled over the next ten years, to NOK 200bn.”