Chinese group Joyvio buys Australis Seafoods for $880 million US

The Financial Market of Chile and Australis Seafoods annouced that a mega operation would shake up the Chilean salmon farming market. Agrosuper Holidings agreed to pay Aquachile $850 million US, the largest takeover in Chilean markets.

The subsidiary of the conglomerate Legend Holdings Corporation, parent of Lenovo, will pay $238 million US for 100% of the company belonging to business mogul Isidoro Quiroga, which is 37%, if the stock value of $642 million US is considered.

Contract of sale

A contract promising the sale by which this company could acquire up to 100% of Australis Seafoods for $880 million US will be adjusted. Each share was bought at approximately $0.12 US per share.

Australis Seafoods is composed of 6,825,687,194 subscribed and paid shares, where the company's securities closed at $63 US per share last Friday on the Santiago Stock Exchange, the company's value is $642 million US.

Reasons for the purchase

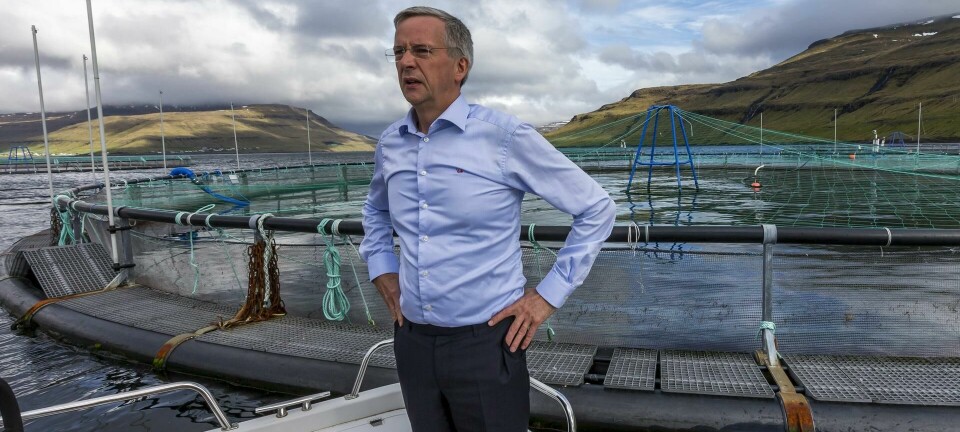

Zhu Linan, executive director and president of Legend Holdings Corporation, stated that Australis Seafoods produced approximately 64 thousand tons of salmon in 2017, representing 9% of the total Chilean activity.

"It has high-quality cultivation licenses, surpassing its industry peers in terms of some key indicators, and is one of the best-managed sector companies in that country.”

“Taking into account the aforementioned period, it recorded audited revenues of US $ 399 million and a net profit of US $ 73.4 million”, said Linan.

"This type of acquisitions is scarce, so the Joyvio group has been successful. Salmon is the most recognized seafood category for buyers around the world with high nutritional content, for its value, high adaptability in taste and, in addition, it is easy to cook.”

The acquisition is a very valuable investment, in line with the strategies of the company's seafood area.

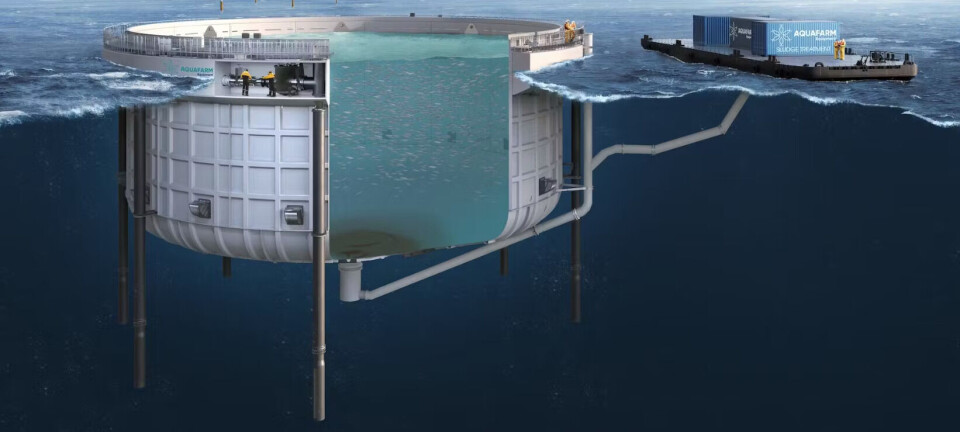

Salmon can be supplied throughout the year, "which represents an incomparable advantage in terms of industry standards, technological leadership and sustainability. It is a mandatory food for the main retail chains of the world, restaurants and seafood vendors."

Scarcity of resources

Linan pointed out that salmon breeding centers are limited in the world and associated farming licenses would mean that many requirements would be needed for breeding.

"The scarcity of these resources is increasingly evident . And the balance between global supply and demand makes their value increase.”

For Linan, Australis Seafoods is a Chilean company, "with good corporate governance, an outstanding management team, leading indicators of performance in the salmon farming industry, a great reputation and a solid profitability”

“It has several licenses in Magallanes, which has the greatest potential for development and extensive natural resources, and is the company with the highest production in that region, which still has a lot of room for growth in the future."

Improve returns

According to the executive, the acquisition will help to quickly strengthen the brand and the influence of the conglomerate in the seafood sector and, therefore, improve its returns of cash and profitability.

"In addition, this market has a lot of growth space, generating significant synergies, because global resources of high quality marine proteins are scarce in China, where it is important to increase food consumption, in addition to the commercial relationship of our country with Chile has complementary advantages”, said Linan.

Legend Holdings is a group of diversified investors in China, with a global presence in five segments: technology, financial services, innovative consumption, agriculture and food, and manufacturing.

Joyvio Group, its subsidiary, is mainly engaged in the fruit business, through has strategic alliances with Chilean companies in the field, animal protein and food supply.

Due dilligence

Martin Guiloff, president of Australis Seafoods, told the CMF that the transaction is subject to compliance with conditions that must be met by April 2019.

Once Joyvio Group has completed its due diligence,including the authorization of the transaction by the Chinese government authorities, as well as the corresponding regulatory approvals in Chile and abroad. It would then launch a Public Offer of Shares within 10 business days.

"If Joyvio Group or the shareholders of Australis Seafoods fail to comply with their obligation to sign the purchase agreement once the conditions are completed, the diligent party may charge the other as compensation for damages the sum of US $ 20 million”, said Guiloff.