Full benefit of Huon investment ‘is still to come’

Tasmanian salmon farmer Huon Aquaculture has warned shareholders that a number of operational benefits expected to be delivered by its now-completed five-year, A$350 million investment programme won’t be seen until its 2022 financial year, which begins mid-way through calendar year 2021.

Writing in Huon’s newly published 2020 annual report, which can be accessed here, chairman Neil Kearney and chief executive Peter Bender are optimistic about the long-term future of the company after a year of much-improved fish health and growth.

But the impact of Covid-19 on sales, and the legacy of incidents that affected Huon’s 2018 year-class, are still being felt.

Significant challenges

“The last two years have presented some significant challenges to the business whether from the secondary impact of lost growth and increased mortalities from the jellyfish and hot summer encounter through to the temporary closure of markets and significant impact of the current Covid-19 pandemic,” write the executives.

“While Huon’s underlying business strategy is unaffected by these events, a number of the operational benefits that we expected would be delivered following the completion of our significant investment program in 2019 have now been delayed until FY2022.

“As the global economy contemplates recession, it would be unrealistic to expect that our business will not be affected by the ongoing changes we have already witnessed in consumer behaviour and our access to traditional channels to market.

Lowering costs

“Your board is, however, confident that the investments made in recent years will support the growth of the business over the long term. A strong foundation has been put in place that will not only enable Huon to increase the production of salmon through its high energy sites but that it will do so sustainably.

“As Huon expands its production further next year it will continue to drive down operating costs per HOG (head on gutted) kg, setting the business up to generate the growth in revenue, earnings and shareholder returns that we know it to be capable of once the current period of economic uncertainty ends.”

Biological assets

Huon has previously announced a post-tax profit of A$4.9m in FY2020, down from A$9.5m in FY2019. This included a A$1.5m increase in fair value adjustment due to the growth in biological assets over the year.

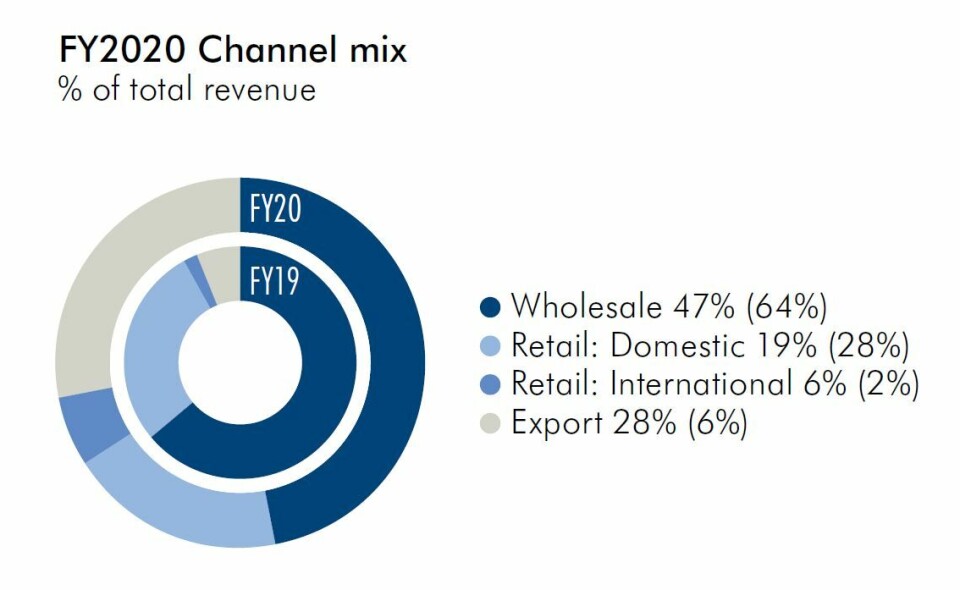

Huon delivered revenues of $339.9m, an increase of 21% on the previous year, largely due to a 36% increase in harvest volumes from 18,849 tonnes to 25,566 tonnes. The company expects to harvest at least 36,000 tonnes in FY2021, which began in July.

In August Huon raised A$64m by selling new shares to institutional investors in a fully subscribed offering. The money is being used to reduce net debt and strengthen the company’s balance sheet and liquidity position after earnings were hit by Covid-19 restrictions.

Huon has raised a further A$2m through the completion of a share purchase plan for existing non-institutional shareholders, around half of the amount if had hoped to raise from the plan.