Andfjord Salmon prepares to stock first smolts

Andfjord Salmon, which is developing a flow-through on-land fish farm in Norway, has started preparations to stock the first smolts in the facility, it said today. The fish will go into the first pool in the second quarter of the year.

“From an operational viewpoint, the fourth quarter of 2021 was the most important and positive quarter in Andfjord Salmon’s history,” said chief executive Martin Rasmussen in a market update accompanying Andfjord’s Q4 and full-year 2021 interim results.

“We completed testing of pool functions and successfully verified the laminar water flow technology at our first pool at Kvalnes. This technology confirmation has de-risked our business case substantially.”

‘Natural habitat on land’

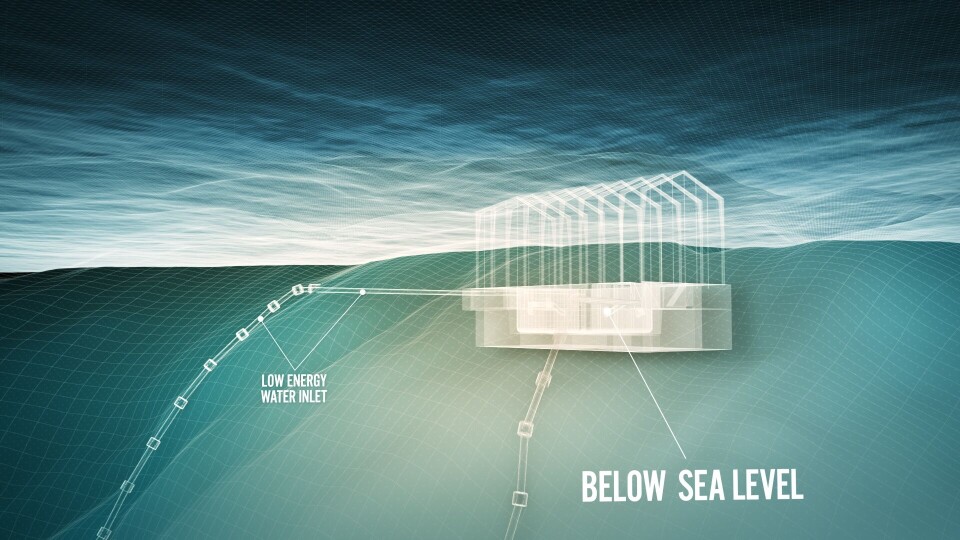

Andfjord says laminar water flow – in at one end of Andfjord’s square tanks and out the other - has enabled it to recreate the wild salmon’s natural habitat on land.

Its use of lined pools blasted into the bedrock below sea level enables it to take sea water from deep in the adjacent Andfjorden, which is warmed by the Gulf Stream. This reduces energy consumption and associated costs significantly as there is no need to lift, filter or heat the water, the company says.

Throughout this year’s first quarter, Andfjord has been working on fine-tuning and pool functions, components and the laminar water flow.

Smolts growing well

“We are on track for our planned smolt release in the second quarter. The smolts are growing well in the smolt facility, so now it is about identifying the ideal timing from a biological perspective,” said Rasmussen.

Andfjord Salmon’s site is at Kvalnes on the island of Andøya. With work on phase 1 – the first pool – all but done, Andfjord has started work on phase 2 and has completed the scraping of the area. A couple of weeks ago, blasting and excavation work started on the next pools. The pools closest to the first pool will be excavated first.

Phase 1 and 2 at Kvalnes represent a total production volume of approximately 12,600 tonnes (head on gutted), and a third phase will take production volume up to 19,000 tonnes HOG.

NOK 9.4m operating loss

As the company is not yet generating revenues, it made an operating loss of NOK 9.4m in Q4 2021, versus a loss of NOK 7.1m in the same quarter last year, mainly due to higher personnel costs in preparation for start of salmon production.

At year-end 2021, Andfjord Salmon had bank deposits and receivables of NOK 49m. This does not include a NOK 20m undrawn credit facility, NOK 6m in available grants, nor the proceeds from a NOK 38m private placement conducted in February 2022.