Cyber-attack has cost AKVA at least £3.4m so far

The direct costs of a cyber-attack on global aquaculture supplier AKVA were NOK 40-50 million (£3.4m-£4.2m), with consequential costs still to be added, the company said today.

Most of the group’s internally hosted services were shut down and data, including backups, were encrypted in the attack on January 10.

No data were lost, and main IT systems are now recovered, although support systems are still to be recovered during the next month, AKVA said in a presentation of its results for the fourth quarter of last year.

Significant non-recurring costs will be recognised in its figures for the current quarter, but the attack would have no impact on Q2 and onwards.

NOK 1 dividend

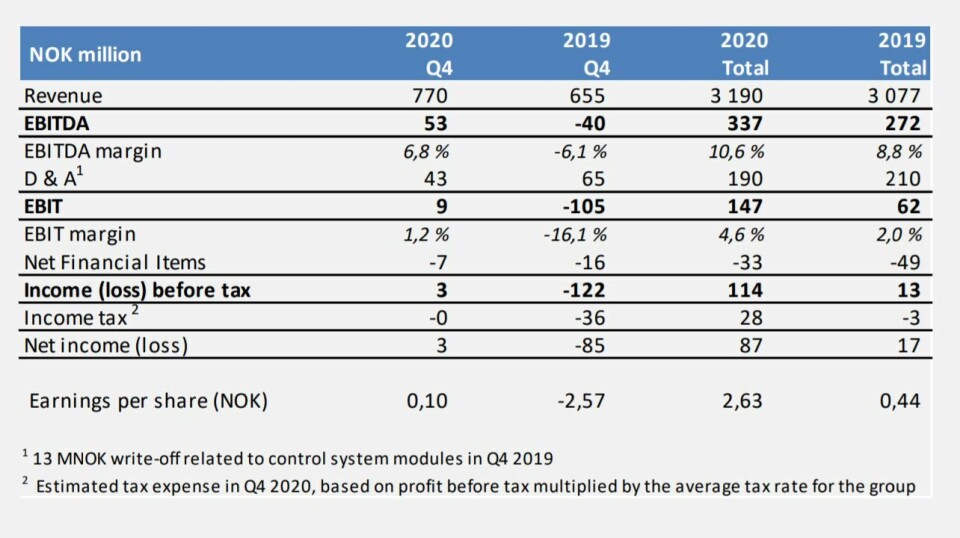

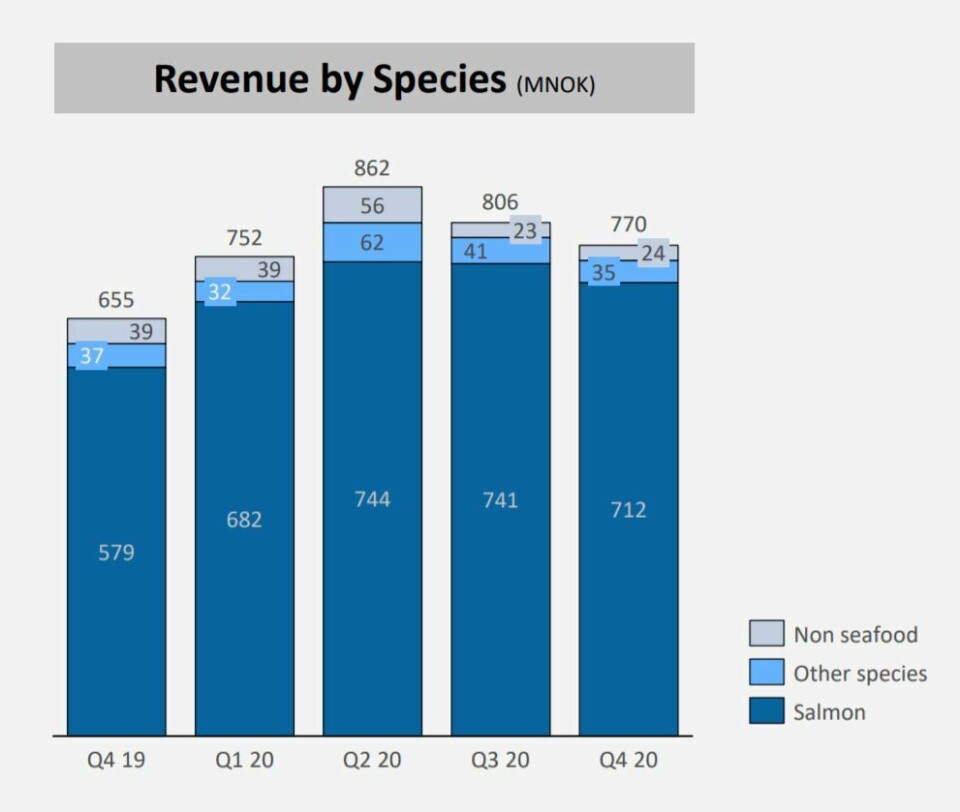

AKVA group had sales in the fourth quarter of NOK 770m (NOK 655m), an increase of 18% compared with the fourth quarter of 2019. EBITDA recovered from NOK -40m in Q4 2019 to NOK 53m in Q4 2020. Net profit increased from NOK -85m in Q4 2019 to NOK 3m in Q4 2020.

The company’s order book was worth NOK 1,864 million (Q4 2019: NOK 1,694m) at the end of the fourth quarter, of which NOK 975m (52%) is related to land-based technology.

The board proposes a half-yearly dividend of NOK 1 per share.

Unsatisfactory quarter

AKVA classed its Q4 financial performance as unsatisfactory, and pointed to a low EBIT margin in the Cage Based segment, which encompasses cages, barges, feed systems, sensors, net cleaning systems, nets and other operational technologies and systems for cage-based aquaculture.

The group’s Cage Based Technology (CBT) sector includes AKVA group Scotland Ltd, AKVA group North America Inc, Newfoundland Aqua Service Ltd., and AKVA subsidiaries in Turkey, Spain and Greece.

“In the first half of 2020, the Covid-19 pandemic affected our land-based segment most with cancellation and postponement of contracts,” AKVA stated. “When it comes to cage-based farming, the impact is mixed as our portfolio of offers is more diversified in terms of geography and customer needs.”

Cage-based sector

Q4 revenues for the cage-based sector ended at NOK 593m (529). EBITDA was NOK 37m (31), and the EBITDA margin was 6.3% (5.9%).

EBIT was -4 MNOK (-26%) and and EBIT margin was -0.7% (-4.9%).

“It was a challenging quarter with significant amounts of quality costs in the cage-based segment,” said AKVA.

Revenues in the Nordic region ended at NOK 363m (323). Order intake in the region was NOK 350m (382), and the order book was worth NOK 497m (494) at the end of December 2020.

In the Americas region, turnover was NOK 141m, up from NOK 123m in Q4 2019. Revenue in Europe and the Middle East was on a par with the fourth quarter of 2019 and delivered a turnover of NOK 89m in the quarter.

Land-based technology

Revenues for land-based technology for the fourth quarter were NOK 157m (110). EBITDA for Q4 2020 was NOKm(-77) and EBIT was NOK 9m(-82).

EBITDA margin was 5.0% (-69.8%) and EBIT margin was 5.7% (-74.6%). Order intake in Q4 2020 was NOK 385m compared to NOK 218m in Q4 2019.

Outlook

In the short term, the company expects some headwinds both in relation to the ongoing Covid-19 restrictions and the costs associated with the cyber-attack the company was exposed to in January.

“However, long-term fundamentals remain unchanged. The financial profile is strong, and the company is fully financed to implement the organic growth strategy,” it said.