AKVA sees revenue rise but profit fall in Q4

Aquaculture supplier AKVA group increased revenue in the fourth quarter of 2018 compared to the same period the year before and had a record-high order intake of NOK 1 billion.

But both operating profit (EBITDA) and net profit fell compared to Q4 2017.

The Norwegian company’s revenue for Q42018 was NOK 726 million (Q4 2017: NOK 557m) with an EBITDA of NOK 57m (NOK 60m). The EBITDA margin was 7.8% (10.8%). Net profit decreased from NOK 27m in Q4 2017 to NOK 19m.

AKVA completed the quarter with an order book worth NOK 1.4bn.

Challenges within cage-based technology

Egersund Net has contributed a turnover of NOK 152m and an EBITDA of NOK 25m in the quarter.

“Compared with last year, the margins have been lower in ASA Nordic due to the challenges of our subcontractors, which has led to increased costs on our barges and lower efficiency on our production lines at Helgeland Plast. On the positive side, service and aftermarket sales in ASA have had a strong quarter,” the company reported.

The order intake in the Nordic regions ended at NOK 498m in Q4, including Egersund Net with NOK 198m, compared with NOK 205m in Q4 2017.

Good activity across the Atlantic

The order intake in the Americas was at NOK 171m in the quarter (NOK 138m).

AKVA group North America signed a framework agreement with Grieg NL for the sale of feed barges in Q3 2018.

“This contract is not included in the order book, as design work remains on the fleets. As a result of good activity and a high order book, revenues for the quarter in Americas were NOK 177m, compared with NOK 127m in Q4 2017,” AKVA’s Q4 reported stated.

Turnover dips in EME

Sales in the Europe and the Middle East region, run from AKVA Scotland’s base in Inverness, were lower than in Q4 2017. But for the year as a whole the region had sales of NOK 344m, compared with NOK 206m in 2017.

“Our businesses in Turkey, Greece, Spain and the Middle East are well positioned to meet future growth in the area,” AKVA reported.

Exports to emerging markets brought in a revenue of NOK 123m in 2018 compared to NOK 32m in 2017, with the main deliveries to Russia and Qatar.

Software

Revenues in the segment were NOK 44m (NOK 46m). AKVA said it continues to invest in the development of new product modules.

“These product modules are expected to further enhance the financial performance of the software segment. The organisation has increased its focus on modernising and upgrading the technical platforms.”

Land-based technology

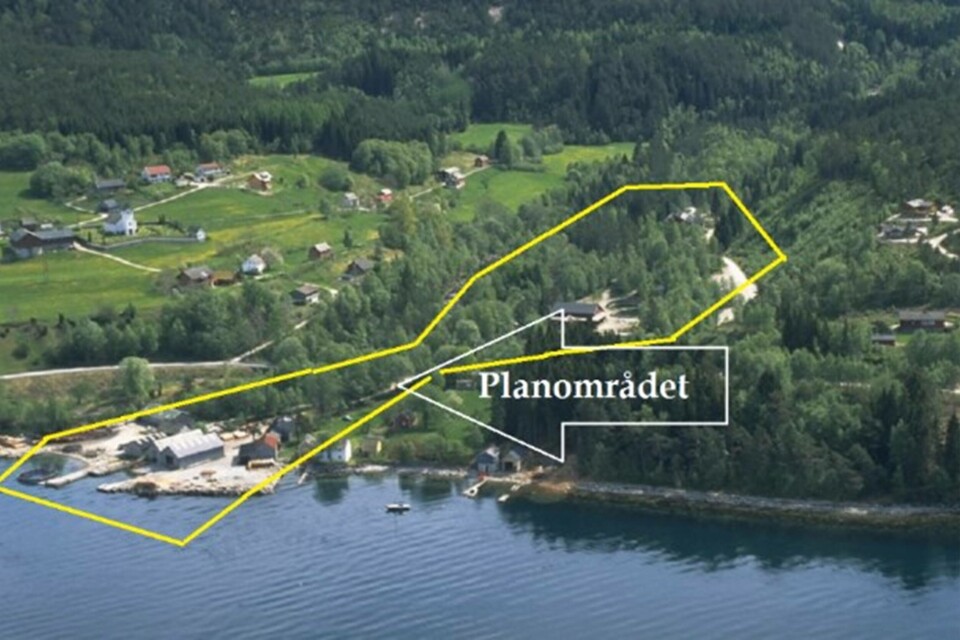

Q4 turnover was marginally up compared to Q4 2017 at NOK 130m (NOK 124m), but the order intake rocketed from NOK 33m to NOK 218m thanks to a deal to build a smolt plant in Norway.

“During the quarter, a significant contract was signed with Ænes Inkubator AS of €15.6 million and in addition, AKVA group Chile entered into an agreement of €3 million. The outlook for new projects still looks good. The order book ended at NOK 448m compared to NOK 537m last year”, reported AKVA.

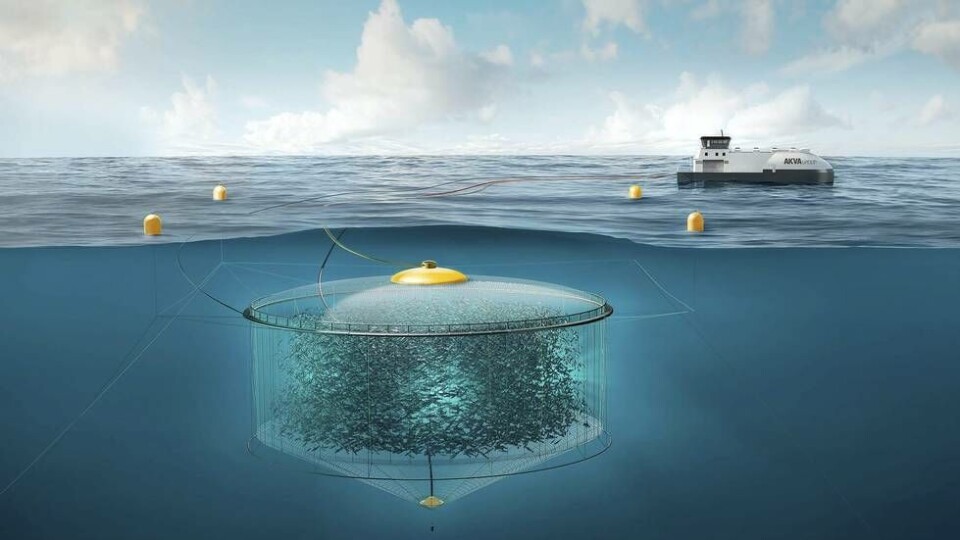

Atlantis Subsea Farming

In cooperation with Sinkaberg-Hansen AS and Egersund Net AS, AKVA group established Atlantis Subsea Farming AS on February 1, 2016 to develop underwater salmon farming facilities on an industrial scale. Although it was granted only one of the six development licences it applied for, Atlantis Subsea Farming AS is now in a technology testing phase regarding the implementation of the project.

Outlook

AKVA said its strong order book in the Nordic regions would have a positive effect on income in the future.

It added that its presence on the east coast in Canada is being built around the framework agreement with Grieg NL to deliver feed barges, which provides a good platform for further development in the area.

AKVA said demand is still good in Chile and that an operational improvement program has resulted in a significant increase in the margins in the company.

“Operational challenges within barge and pipe manufacturing, as well as a claim of exceptional nature have impacted the earnings negatively in 2018, of which the most significant have been estimated at NOK 29m (in addition to NOK 9m of transaction costs). Measures are implemented to avoid such issues for the future.”

Development programmes for innovation in feeding systems, cage-based systems, Fishtalk (software) and AKVA Connect (hardware control systems) have been established for 2019.