Salmon stays ahead in US retail market

Consumers in the United States showed a strong preference for salmon in the third quarter of the year, a US retail expert said during a webinar presented by MSD Animal Health.

Anne-Marie Roerinck, chief executive of Texas-based market research company 210 Analytics, explained that rising restaurant food prices have led many consumers to avoid eating out, opting instead to buy fresh and frozen seafood in stores, reports Fish Farming Expert's Chilean sister site, Salmonexpert.cl.

“In the fresh food segment, salmon has outsold other seafood options, showing solid results compared to the previous year, with a notable increase in units sold. In addition, in the prepared food area, ready-to-cook salmon in the oven has gained relevance due to its convenience, allowing consumers to prepare a quality dish in less than 30 minutes,” said Roerinck.

“In the frozen food sector, salmon has also registered an increase in sales by volume, consolidating itself as one of the favourite options of the American consumer, who values both its nutritional benefits and its versatility in the kitchen.”

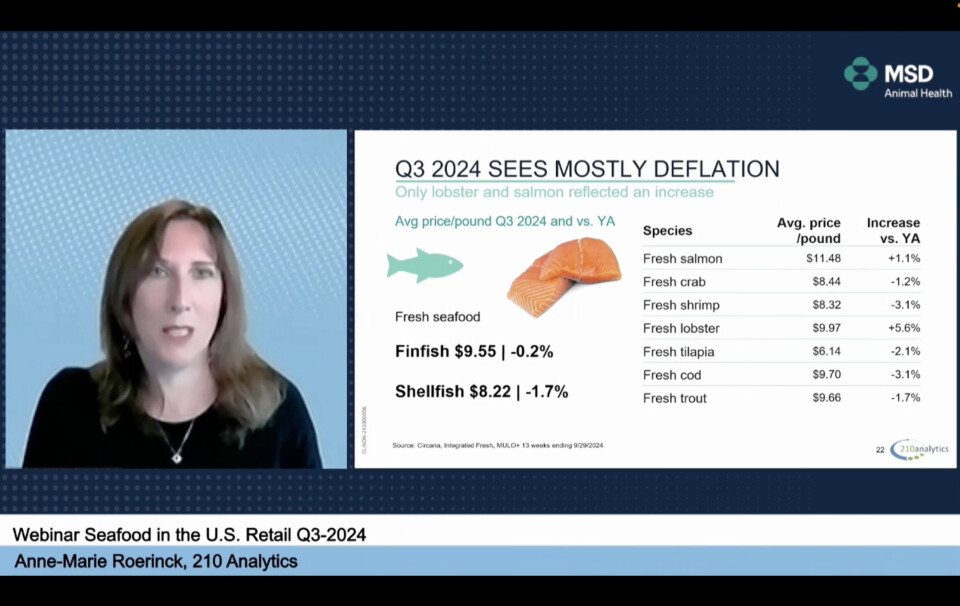

Price differences

Fresh fish had an average price per pound of US$9.55 in Q3, 0.2% less than in the same period last year. In this category, fresh salmon showed a price of $11.48/lb, 1.1% more than the same quarter of 2023. In the frozen category, salmon showed a price of $9.02/lb, which was 4.5% lower than in the third quarter of last year.

The price difference between fresh and frozen was reflected in sales. Frozen salmon had sales of $254 million, with a 0.5% increase in returns and 5.2% increase in volume. But despite its popularity in the fresh fish sector, fresh salmon sales of $976m were down 0.2% in value and 1.4% in volume compared to Q3 2023. Canned salmon recorded quarterly sales of $71m, 2.9% less than the same quarter in 2023.

Roerinck said the popularity of prepared seafood has been remarkable, with considerable growth in the sale of products ready to be cooked in the oven or in air fryers, responding to consumer demand for convenience.

“These types of products, such as ready-to-bake salmon and shrimp dishes, have been well received and represent a growth opportunity in the retail market. In addition, refrigerated seafood, such as sushi and shrimp, have maintained a positive performance due to their ease of consumption on special occasions and for entertainment,” said the analyst.

Sustainability matters

Sustainability remains a relevant issue for US seafood consumers.

According to Roerinck, concern for animal welfare and environmental impact has led many companies to highlight certifications and allocate a percentage of their sales to support ecological initiatives.

“This trend indicates that consumers increasingly value responsible and sustainable practices in the seafood industry.”

As the US holiday months approach, consumers are expected to increase their spending on food, including seafood. “High seasonal demand could benefit the industry, particularly for convenience and entertainment products such as shrimp platters and sushi, which are popular at family celebrations. Retailers will therefore focus their strategies on promotions and discounts to attract consumers during this key season,” Roerinck said.

“Point-of-sale promotional strategies will be key, as seafood prices are expected to remain stable or even decrease, thus encouraging purchases.”

Convience counts

Convenience will continue to be a priority, with growing demand for ready-to-eat or easy-to-prepare products. A slight increase in demand from the food service sector is also anticipated, especially in venues such as hotels, conferences, and in the state school system, suggesting an expansion of consumption opportunities across multiple channels.

“The interaction between frozen, canned and chilled seafood products will play an important role, as most consumers use all of these categories for their everyday meals,” said Roerinck.